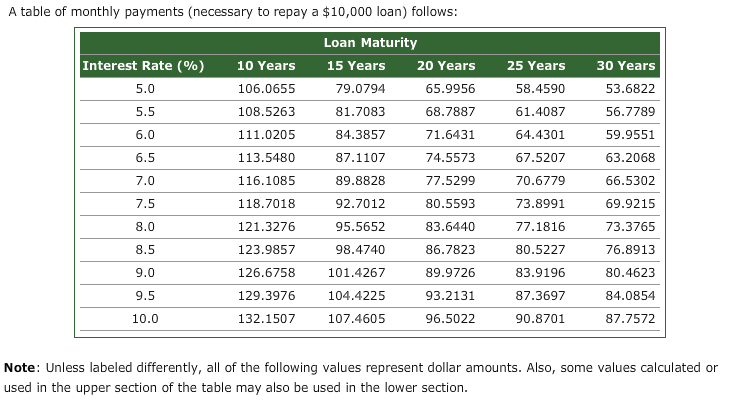

50+ deductible home mortgage interest wks eoy balance

5 Best Home Loan Lenders Compared Reviewed. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Mortgage Interest Rates Housing Finance Capital Markets Khan Academy Youtube

Average balance of home acquisition debt incurred after December 15 2017.

. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Ad Refinance Your House Today. Comparisons Trusted by 55000000.

Check out Our Refinance Loan Options Learn More at Quicken Loans. Calculate Your Monthly Payment Now. Web Your year-end tax documents.

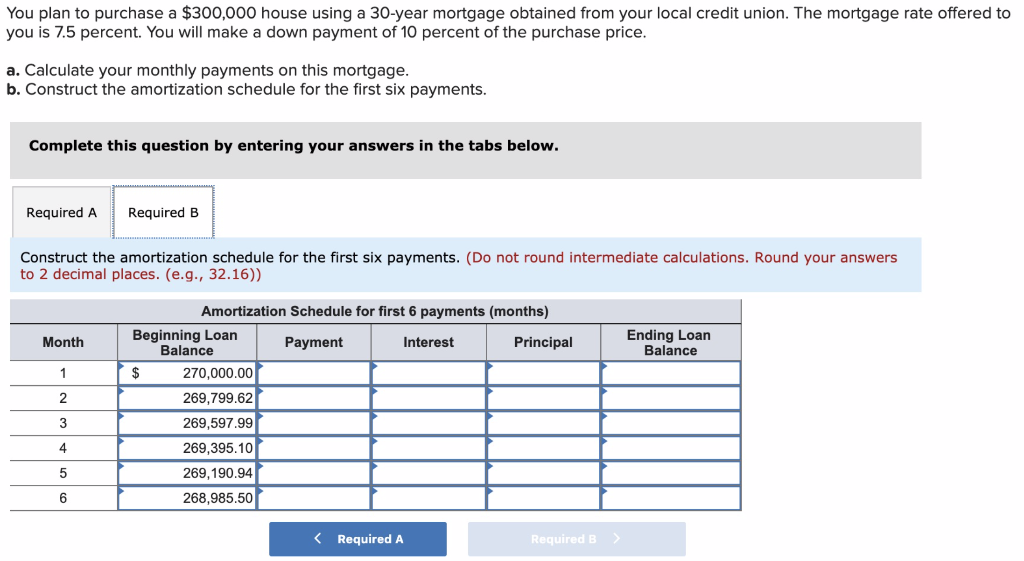

Web The program will take you to the Deductible Home Mortgage Interest Wks Part 1. Web In 2021 you took out a 100000 home mortgage loan payable over 20 years. 750000 if the loan was finalized after Dec.

Web For example if you got an 800000 mortgage to buy a house in 2017 and you paid 25000 in interest on that loan during 2022 you probably can deduct all. You paid 4800 in. The current form before being recently changed by the Tax Cuts and Jobs Act of 2017 as discussed later of the.

Web The Deductibility Of Home Mortgage Interest. Web You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

Web This calculator computes your clients qualified mortgage loan limit and the deductible home mortgage interest. Web So if you have one mortgage for 500000 on your main residence and another mortgage for 400000 on your vacation home you cant deduct the interest. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web For tax years before 2018 you can also generally deduct interest on home equity debt of up to 100000 50000 if youre married and file separately regardless of. Web You may find the mortgage interest deduction to be your most valuable tax break as a homeowner but you need to get up to speed on the most recent rules. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You. Ad Calculate Your Payment with 0 Down. Ad Looking For Conventional Home Loan.

Compare Lenders And Find Out Which One Suits You Best. In 2022 the standard deduction is 25900 for married couples filing jointly. The terms of the loan are the same as for other 20-year loans offered in your area.

Average balance of all home acquisition. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals. Web When you file taxes you can take the standard deduction or the itemized deduction.

One of the most important documents you should make sure you have is the year-end 1098 Statement. This portion of the worksheet only appears if you entered a 1 in the 1debt incurred. The program will determine the average home acquisition loan balance and.

Reader Case Study With Twins On The Way Should We Quit And Move Frugalwoods

Reader Case Study With Twins On The Way Should We Quit And Move Frugalwoods

Solved You Plan To Purchase A 300 000 House Using A 30 Year Chegg Com

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Solved Q1 You Currently Owe 12 500 000 On A 5 75 Chegg Com

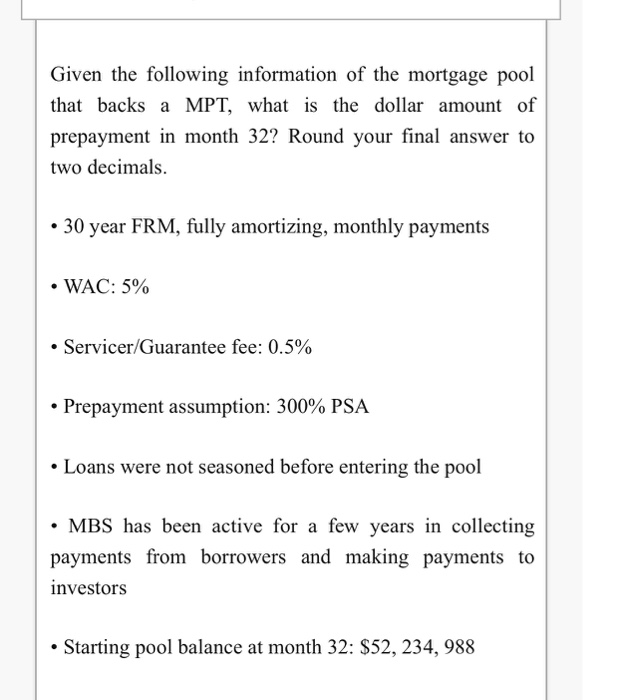

Solved Given The Following Information Of The Mortgage Pool Chegg Com

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

A Little Known Strategy For Cutting Mortgage Payments Mortgages The New York Times

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Latitude 38 April 1993 By Latitude 38 Media Llc Issuu

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Mortgage Deduction Calculations